Starwood Farms (sold out)

Northwest Houston continues to be one of the fastest-growing areas not only in Houston, but in the country. With the completion of the Grand Parkway Tollway (highway 99), growth is accelerating.

Included in this Project...

MAXX Property Management

All FIG properties are professionally managed by MAXXPM in order to minimize vacancies and maximize your rental income.

Vollkommen Construction

Co-founder of FIG, Vollkommen brings a long history of building high-end custom homes and combines it with their passion for helping multifamily investors.

First Colony Mortgage

FIG's preferred lender has helped our investors secure over $250M in multifamily financing over the last three years.

Fourplex Investment Group

Since 2013, the FIG companies have built over 4,000 doors of multifamily units, providing investors with over $500M in cash flowing properties.

About Us

Why This Market?

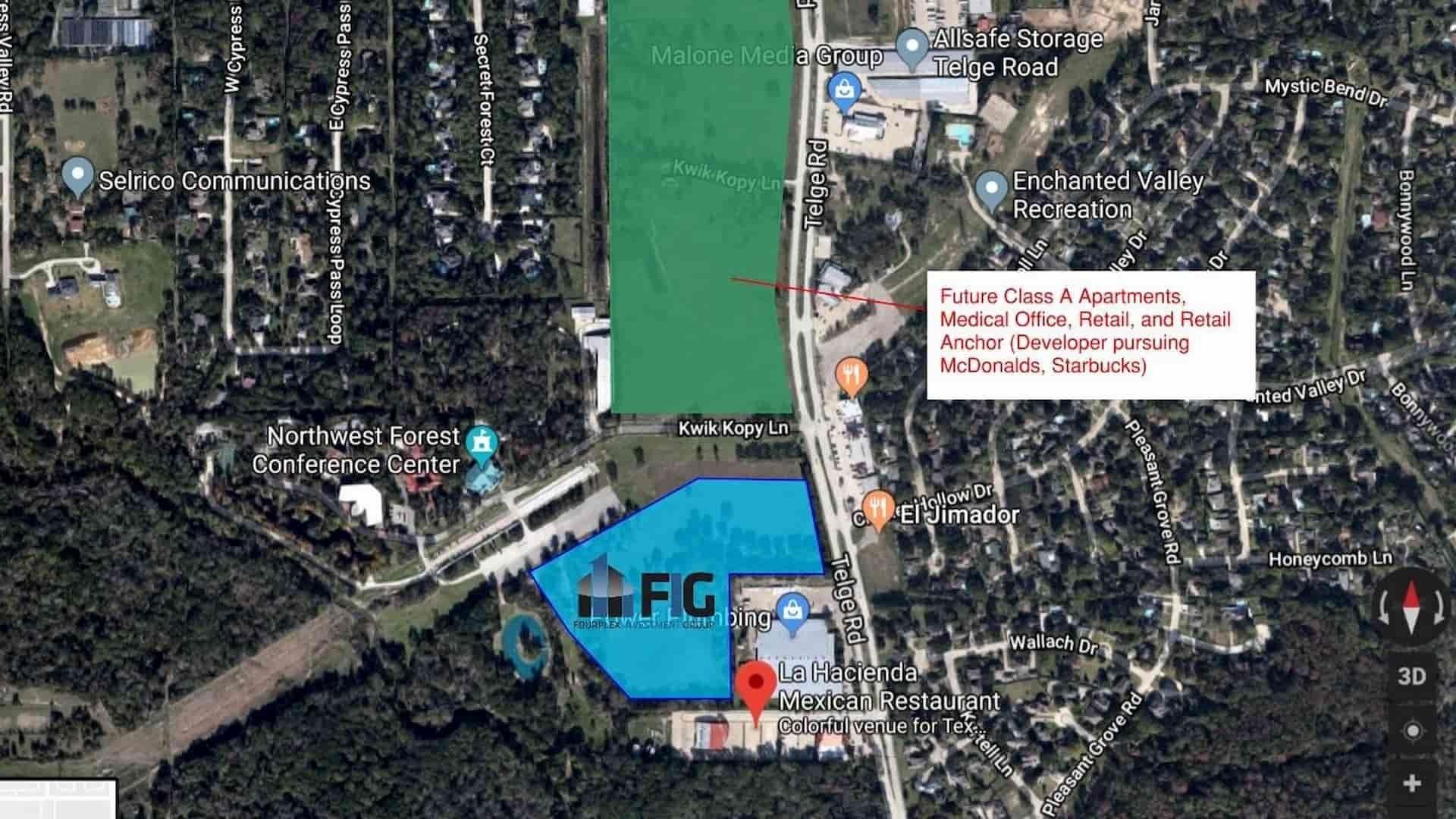

Northwest Houston continues to be one of the fastest-growing areas not only in Houston but in the country. With the completion of the Grand Parkway Tollway (highway 99), growth is accelerating. Exxon Mobil, Baker Hughes, and a host of other companies have poured into the area. In the long-term, Northwest Houston is poised to benefit from many of the factors that led to the strong growth earlier this cycle: People want to be in North Houston for the schools, jobs, affordability, and quality of life.

This isn't likely to change anytime soon. In the near term, a slowdown in multi-family construction should allow fundamentals to tighten and vacancies to lower. Oil also being consistently above the $60/barrel level has been good for Houston, with jobs and people returning. However, Houston is now quite diverse in employment and does not depend exclusively on oil. Job growth in services, medical, and transportation (just to name a few) has been substantial. FIG Starwood Farms is poised to profit in Northwest Houston's path of progress.

All Starwood Farms units are sold through the FIG team via RE/MAX Advisors.

Call us at: (801)494-1651

Houston Market Report

With the completion of the Grand Parkway Tollway (highway 99), growth is accelerating. Exxon Mobil, Baker Hughes, and a host of other companies have poured into the area...

DOWNLOAD REPORT