Real Estate Guys Talk FIG

Aug 10, 2021Excerpt from the RE Guys Radio Show: Watch on YouTube

Russell Gray:

[Steve Olson] has turned out to be such a great resource because he has really a unique vantage point.

First of all, he's just a straight shooter. He knows what's going on in his business, and he just tells you. He's not trying to spin it. You know he's "land is more expensive, materials cost more, this is a problem market. We face struggles here, we figure it out." He's got a positive attitude but he isn't Pollyanna. I really appreciate that about the people I count on for actionable intelligence. I want the straight scoop, I don't want to get sold.

The fact that [Fourplex Investment Group] is in multiple markets, and can compare how Boise behaves versus how Houston behaves versus how Salt Lake City or Phoenix behaves, and is in the same asset class. [They're] in the same product niche, in different markets, which basically serves the same demographic in different markets. But the markets themselves are different.

Now, some things they have in common. I mean, he's smart. Like I think most strategic real estate, investors. [FIG's] going to pick jurisdictions that are going to be basically friendly to landlords and entrepreneurs. They're going to be more affordable. There are going to be places where there are population and economic drivers. These are big metros, you know, they might be suburbs of big metros, but they're based on something they're not way out in the sticks.

When you have somebody who has that kind of vantage point, that's willing to shoot straight with you, then you can really get some insight.

The other thing is one relationship gives you the ability to diversify in multiple markets. When you're a busy person, you're a professional, you're earning a lot of money and you're trying to get out of the ease of stock market investing so that you can get away from the volatility and the risk of stock market investing. And you can roll into the real estate side of things and have one relationship with somebody that has a lot of inventory in multiple markets. There's a lot of leverage in that.

Robert Helms:

I sure do like [Steve Olson's] candor. One of the things he talked about was when you invest in this type of investment—a brand new, turnkey, if you will—build-to-rent property, it just takes some time. It's not going to be built overnight. These guys have been working on it for a long time before you enter the picture, but they bring you in at a strategic point, which lets you get a little better buy.

We'll leave those details to your conversation with Steve if you're interested in that. But I think it's it's unique. Also, the fact that the markets change. When you're looking at their product type, they have these beautiful campuses that look like nice quality apartment buildings, but they're all townhouse style, yet they're individually plotted. So each one's a fourplex, but the tenant doesn't know that.

One of the other challenges he was upfront about is the lease-up, if all of a sudden 200 units or 100 units hit the market. They don't all lease overnight.

Sure, they've picked markets where there's demand, and they know that there are tenants looking for properties in that price range. But it takes some time. So the big picture on that, not just from Steve, but people who listen to our show know that we're very reality-based. It's not just happy high notes. It's not just rainbows and unicorns, there are challenges with real estate. It happens all the time.

Every October, we do Halloween horror stories, which is a collection of things that went desperately terribly wrong with actual living breathing, real estate investors. But more importantly, the lessons that you learn.

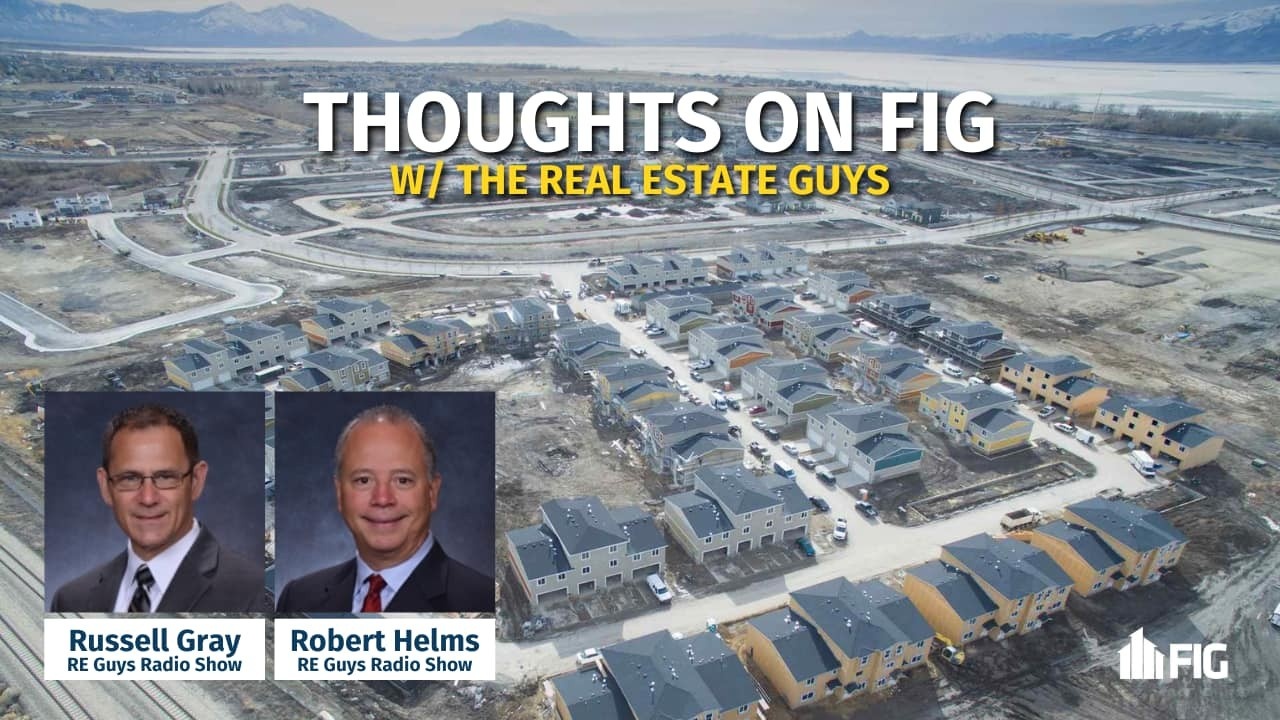

It's great watching the evolution of FIG, the Fourplex Investment Group because when we met them they were only in Salt Lake. As they've explored new markets, decided on a few, built team, and have that compared to what reference you were talking about. Now they really do offer a variety of types of investments that is more market-driven even than product-driven.

Russell Gray:

Speaking of compared to what. I am a Camaro guy, I had two Camaros, one in high school, one right out of high school in 1968. I love those cars. Later in life, I had one of my multiple midlife crises, I decided I wanted to go back and kind of get that old sports car again.

I looked at old Camaros and I liked the look. I liked the feel. I like the big motor. But I didn't like the fact that they were old. I wanted new car amenities. And so what I ended up doing was buying a modern Camaro that was based on a retro look. And I have all the modern amenities. It's a brand new, nice, beautiful car. But it kind of still has that throwback look.

When I look at the fourplex [niche] I think about when you go out in the marketplace, and you want all of the advantages of a fourplex, typically you've got to buy a pretty old property in a pretty old neighborhood. To have the ability to buy a brand new fourplex and get all of the benefits, plus have a brand new property from a developer that is focused on not building properties, but building neighborhoods.

When he started talking about the master-planned community, the HOAs. Some of the things that go wrong in those older properties are where people can kind of do whatever they want in the property and the neighborhood deteriorates. By mitigating that risk, they've really offered the investor a very unique situation. A new property in a masterplan community with the ability to diversify across multiple markets with only one relationship. I think it's fabulous.

Robert Helms:

When he was talking about the typical fourplex neighborhood, while having a lot of experience in those typical fourplex neighborhoods, I'm like, Yeah, that's it. Not only the neighborhood but exactly what you're talking about.

I remember one of my fourplexes I got a call from the tenant upstairs saying the water heater had gone out. And it's like, oh, no, I can't remember if that whole building has a water heater, or if they're individual. In this case, they were individual water heaters. While the guy was out putting a new one in, another one broke. So I said, you know what, just replace them all. It's an old building.

That's a big chunk of cash. The attraction of a brand new property with a builder's warranty that has that appeal to tenants makes a ton of sense.